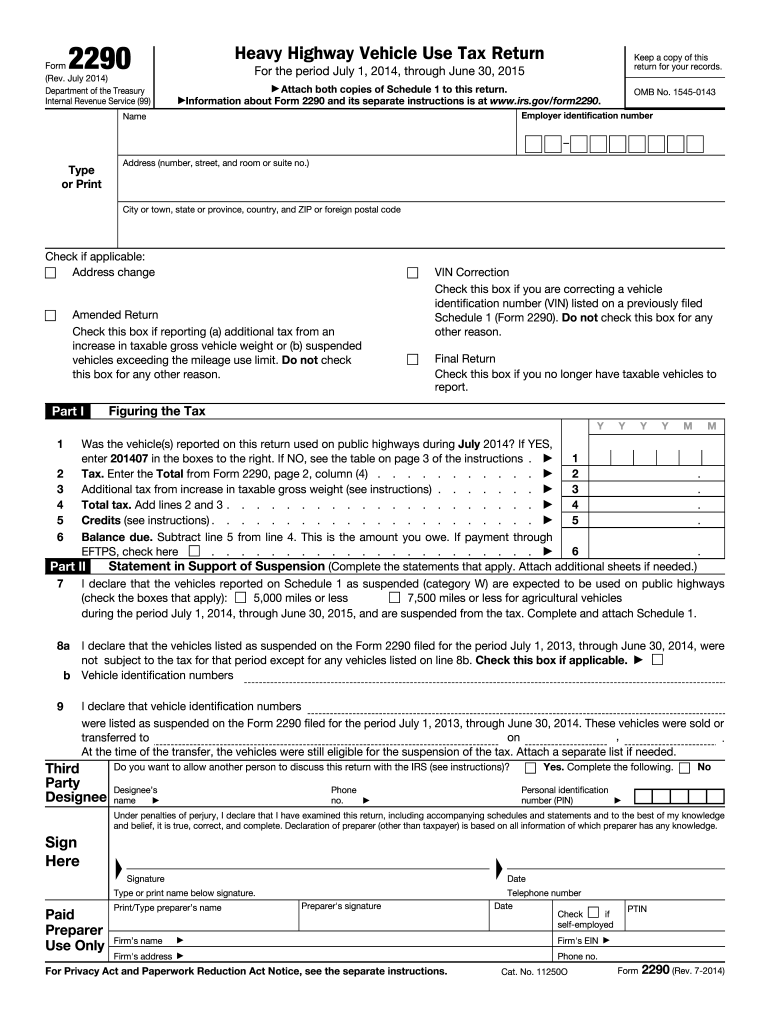

You can't make changes once your return is acceptedįree File Fillable Forms is the only IRS Free File option available for taxpayers whose 2021 income (AGI) is greater than $73,000.

No state tax return option is available.It will only file your federal return for the current tax year.It only performs basic calculations and doesn't provide extensive error checking.It won't give you guidance about which forms to use or help with your tax situation.Limitations with Free File Fillable Forms include: If you choose Free File Fillable Forms as your Free File option, you should be comfortable doing your own taxes. Electronically sign and file your return.Start Free File Fillable Forms About Free File Fillable Formsįree File Fillable Forms are electronic federal tax forms you can fill out and file online for free, enabling you to:

#ONLINE FREE FORM FILLER PDF#

If your corrected return is not accepted by October 20, 2022, mail in your printed copy. PDF Escape is a free application which lets you view / open and edit PDF files online.It is useful to edit PDF documents online.It has got a lot of features which lets you even create or design PFD forms and it can also be used as a PDF Form Filler.This online PDF reader tool is the best way to create and edit PDF files online.Check out our previous articles like. If you receive an email saying your return was rejected, you must correct any errors and resubmit your return before October 20, 2022.Īfter you submit your return, you should receive an email from verifying the IRS accepted your federal return.

You Must Create a New Account Each Year Read Before Starting Octowas the last day taxpayers could access their accounts for tax year 2020 returns. The program operates every year from mid to late January until mid-October.įrom October 16 through October 20, taxpayers could access their account, resubmit rejected returns and print returns.

0 kommentar(er)

0 kommentar(er)